David Xiaoyu Xu

What Do Lead Banks Learn from Leveraged Loan Investors? (with Max Bruche and Ralf Meisenzahl)

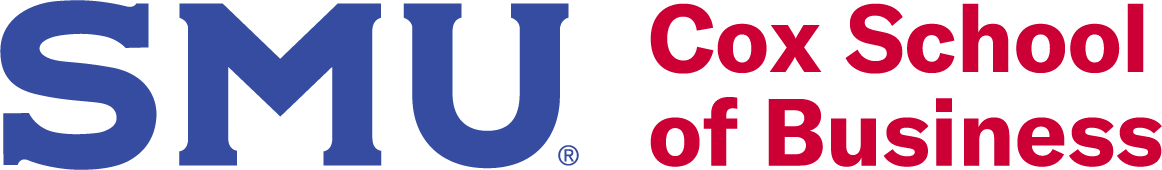

Nowadays in syndicated lending it's standard practice that lead banks adjust loan pricing based on investor demand revealed in the bookbuilding process. We find these pricing adjustments highly informative about future loan performance, which suggests nonbank investors have private information about borrower credit quality that is not reflected in bank-proposed loan terms.

Our observation on the 2014 Millennium Health Deal , where the borrower's fraud led to investor lawsuits against the lead bank and a 2023 federal court ruling that "leveraged loans are not securities".

Information Acquisition by Mutual Fund Investors: Evidence from Stock Trading Suspensions (with Clemens Sialm)

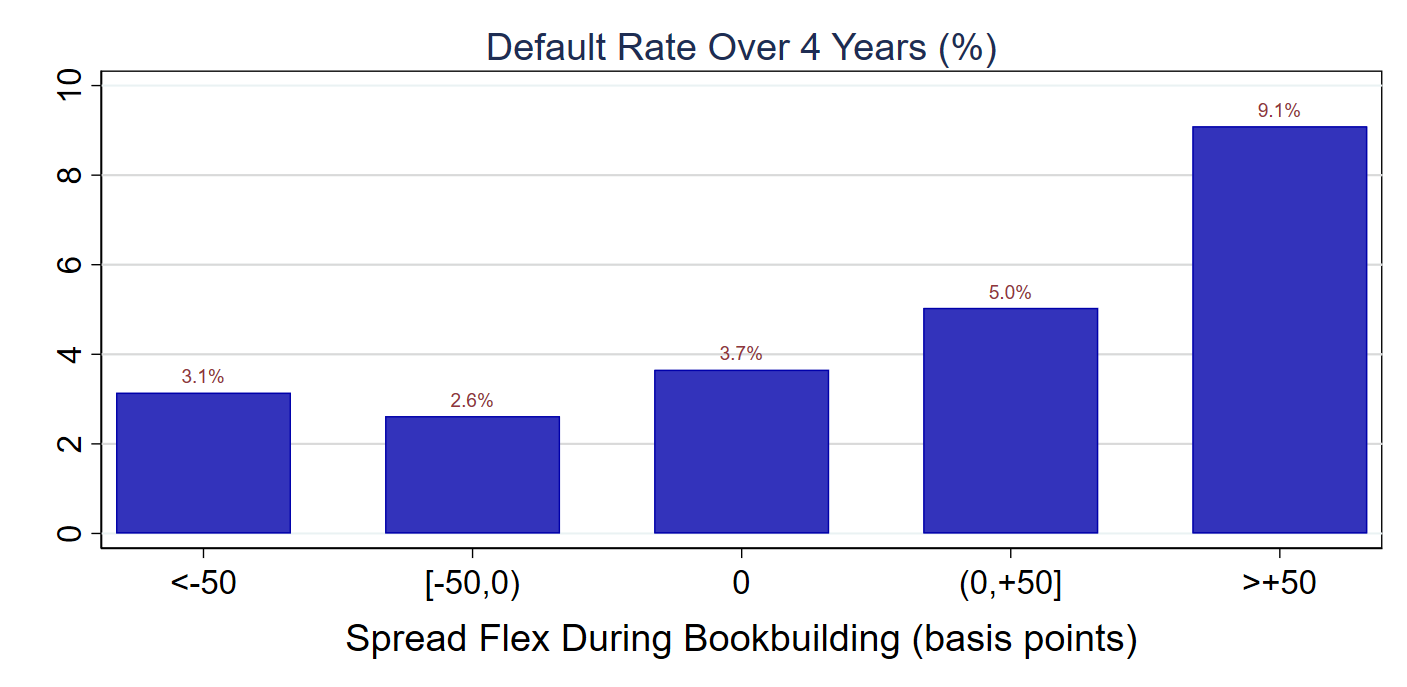

Mutual funds create liquidity for fund investors by holding illiquid assets, which often have inaccurate valuations. This liquidity creation stimulates information acquisition and generates informative quantity movements ("flows") before the information incorporates into asset prices.

Illiquidity Meets Intelligence: AI-Driven Price Discovery in Corporate Bonds (with Stacey Jacobsen and Kumar Venkataraman)

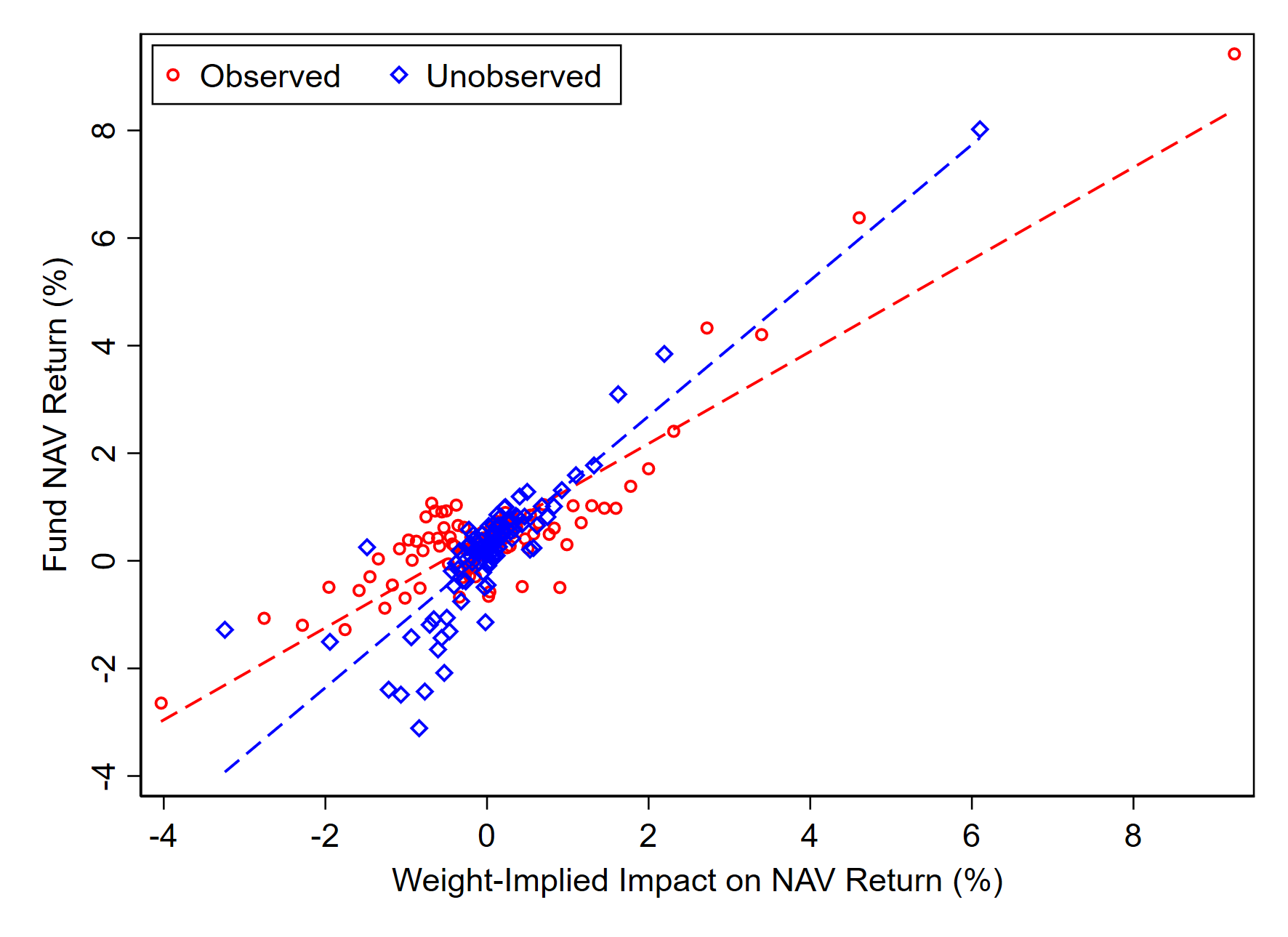

When illiquid assets don't trade, post-trade transparency offers limited help. We show that AI improves price discovery in these markets by feeding diverse information into high-frequency price predictions—but how well it works still depends on market conditions.

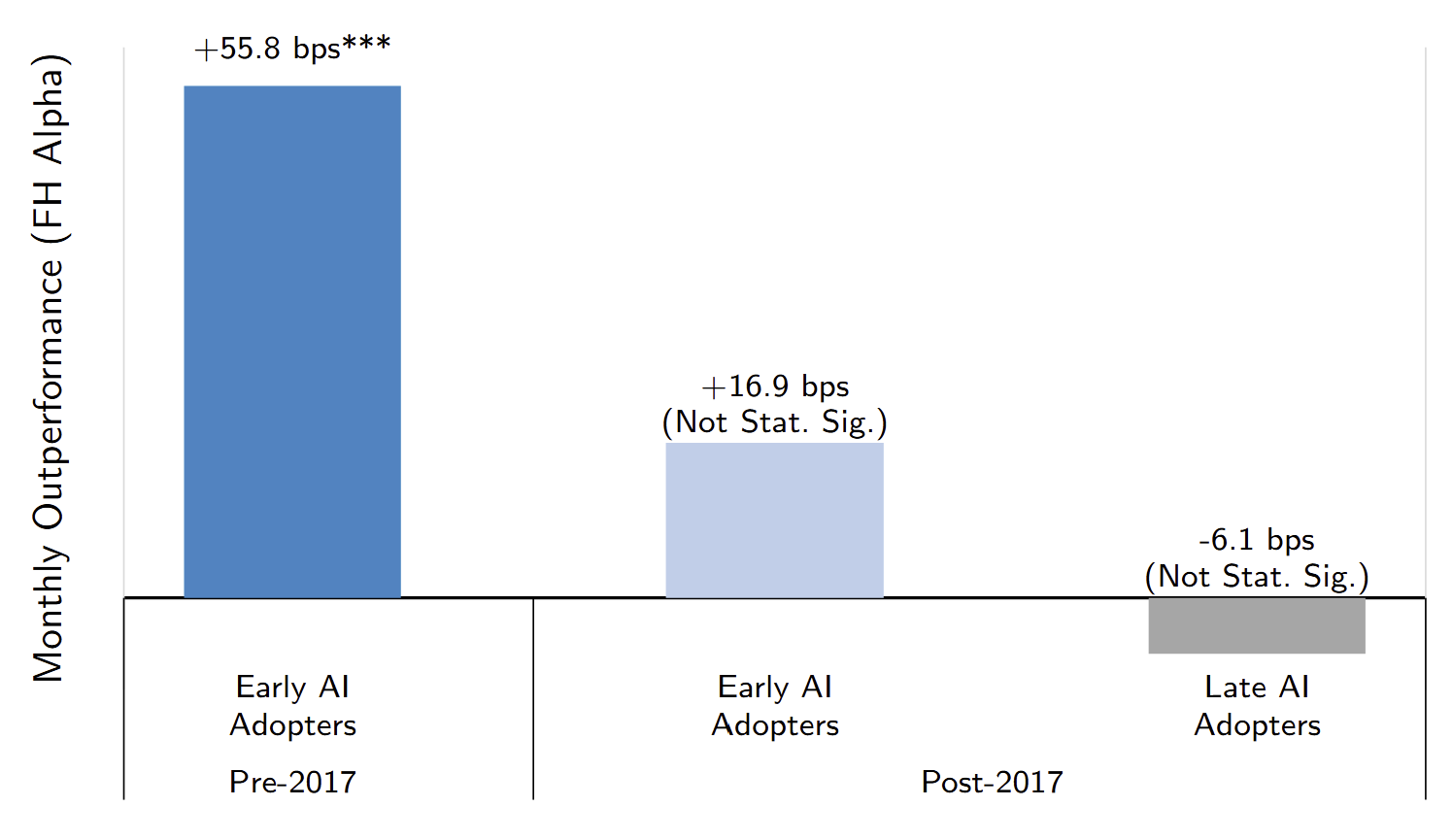

The Growth and Performance of Artificial Intelligence in Asset Management (with Shuang Chen and Clemens Sialm)

We search across the asset management industry and find that AI-driven investing is concentrated among hedge funds, with a large share in macro strategies. Their early outperformance relative to non-AI funds declined over time and disappeared with the growth of AI funds.

Human Capital and Local Credit Supply: Evidence from the Mortgage Industry (with Ruidi Huang, Erik Mayer, and Sheridan Titman)

Physical locations of loan officers remain important for local credit supply, even in the 2020s. However, the supply of loan officers themselves is largely unresponsive to local credit demand. Tracking 350,000 loan officers, we find this inelasticity affects the supply of mortgage credit across U.S. counties.

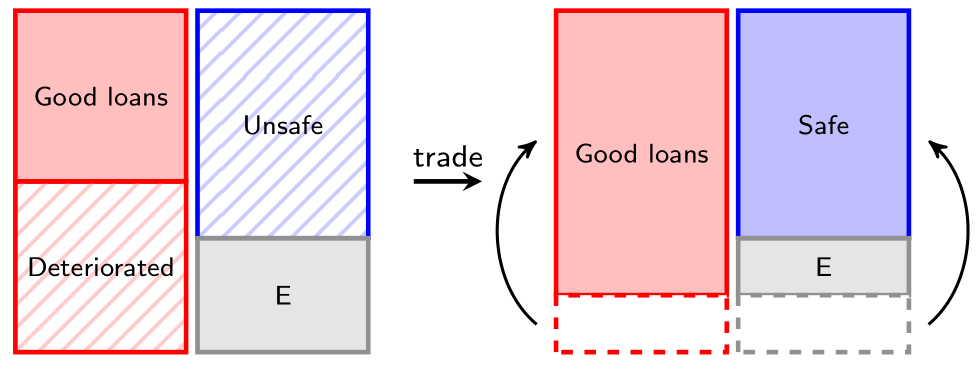

Portfolio Dynamics and the Supply of Safe Securities [Internet Appendix]

Management Science, accepted

QCGBF Young Economist Prize, Finalist

FMCG Best Paper Award in Banking/Financial Institution

The size of safe tranches (e.g., AAA-rated) backed by risky loans is constrained by potential loan quality deterioration in future years. A "self-healing" mechanism whereby asset managers pre-commit to replacing deteriorated loans in the underlying portfolio relaxes the constraint. This novel mechanism shapes equilibrium in the securitization of corporate loans.

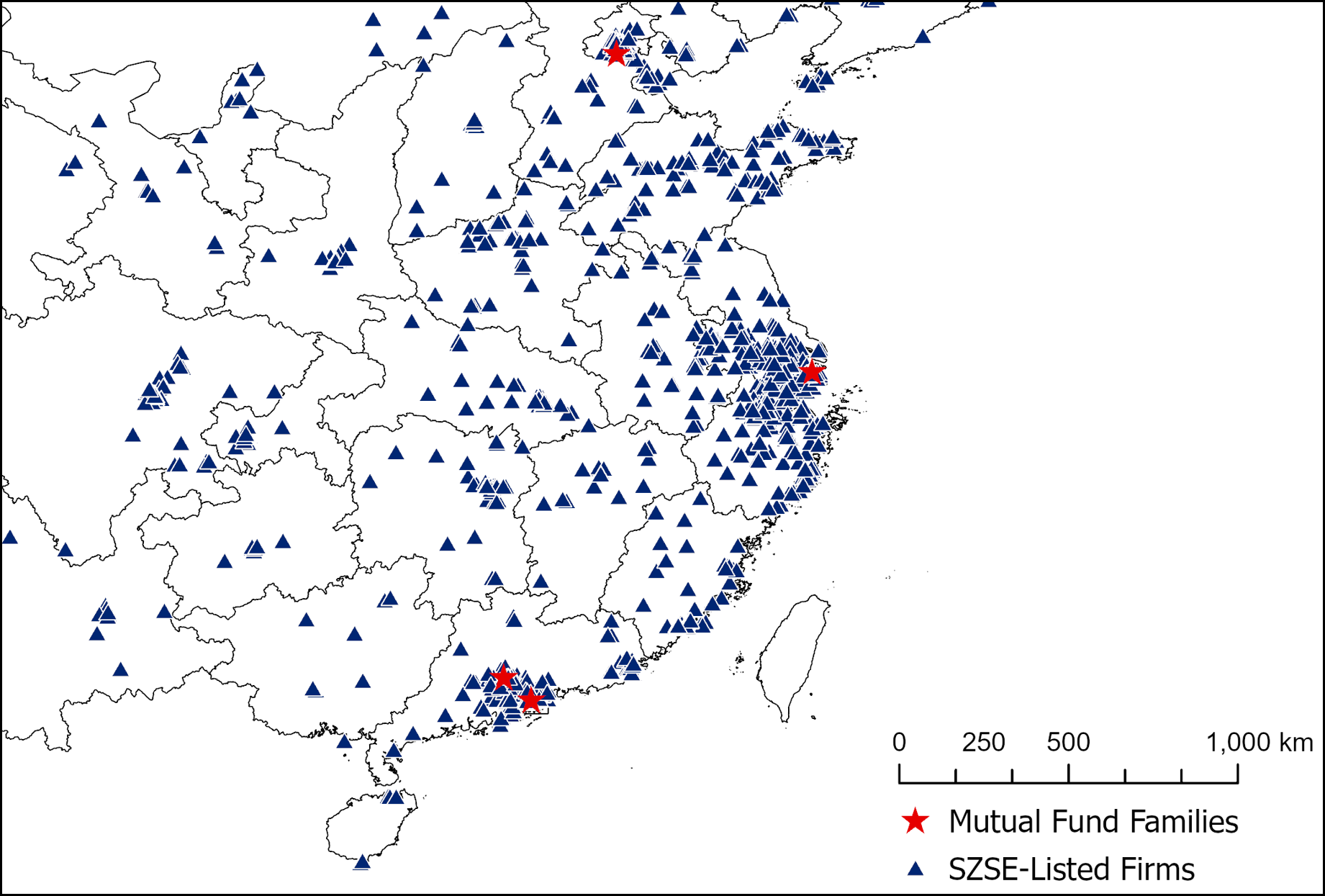

The Geography

of Information Acquisition (with Honghui Chen, Yuanyu Qu, Tao Shen, and Qinghai Wang),

Journal of Financial and Quantitative Analysis, 2022

A setting where investment professionals' acquisition of private information is observable. We use this setting to examine how they react to exogenous shocks to the cost of acquiring information.

Subsumes my second-year summer paper: Costly Information Acquisition and Investment Decisions: Quasi-Experimental Evidence